MTN Nigeria’s service revenue increased by 35.6% in March following tariff adjustments introduced in February.

A report from the company’s group office in South Africa on Monday also indicated that further growth is expected in 2025 as a result of these tariff changes.

Meanwhile, MTN Group reported a 69% drop in full-year earnings, largely due to the devaluation of the Nigerian naira and operational challenges in Sudan.

The company’s headline earnings per share (HEPS), a key profitability measure, fell to 98 cents for the year ending December 31, down from 315 cents in 2023.

“Despite challenges including currency depreciation in Nigeria, elevated inflation, and ongoing conflict in Sudan,” MTN Group’s President & Chief Executive Officer, Ralph Mupita expressed optimism about the future.

He noted signs of easing inflation, reduced forex volatility—particularly for the naira—and the positive impact of tariff adjustments in Nigeria.

“In Nigeria, we renegotiated tower lease contracts, which allow MTN Nigeria to better manage adverse macroeconomic impacts on the business.

“MTN Group is well positioned to capture the exciting opportunities in our markets and deliver on our medium-term objectives to sustain growth, create shared value in nation-states and communities, and unlock value for our stakeholders,” Mupita stated.

Nigeria has faced persistent dollar shortages, prompting authorities to devalue the naira as part of efforts to stabilize the currency and attract investment.

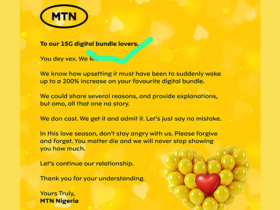

Combined with high inflation and rising interest rates, these challenges have significantly increased costs, causing MTN Nigeria’s pretax loss to surge by over 200% to 550.3 billion naira ($355.76 million).

READ ALSO: 2027: I’ll Only Support Anyone Willing to Leave Office After Four Years – Kenneth Okonkwo

MTN Group, which has 291 million customers across 16 markets in Africa, said its group service revenue decreased by 15% to 177.8 billion rand ($9.78 billion). In constant currency, group service revenue rose 14%.

It declared a final dividend of 345 cents per share, up from 330 cents.

Highlights:

- Solid underlying performance with strong H2 financial results. Service revenue, earnings, cash flow and leverage all improved in the second half of the year

- Service revenue up by 14% in constant-currency terms; down 15% in reported rand terms

- MTN Nigeria’s service revenue is up by 35.6% and expected to increase in 2025 after tariff adjustments implemented in February 2025

- MTN South Africa service revenue up by 3.1% with reported EBITDA margins strong at 37.4%

- Fintech service revenue up by 28.5%, with transaction value up by 35% in constant currency at US$321bn

- Fintech advanced services revenue (including bank tech, remittance, and payments) is up 52%

- Group medium-term guidance maintained as 2025 starts on a strong footing

- Dividend at 345cps increased on positive second-half momentum in earnings, free cash flow and leverage. The MTN Board anticipates paying a minimum ordinary dividend of 370cps for the 2025 financial year

In Ghana and Uganda, the firm increased local ownership in our operations. In South Africa, it extended the MTN Zakhele Futhi broad-based black economic empowerment transaction.

“This underscores our dedication to transformation and creating shared value and remains integral to our future success,” Mupita said of the Group that celebrated 30 years of operations in 2024.

Other key achievements included further reductions in the Group’s Scope 1 and 2 emissions and expanded broadband coverage, now reaching 93% of the population across its markets.

Additionally, the company made significant progress in extending broadband access to rural and remote areas, a crucial step in its mission to promote digital and financial inclusion across Africa.

Follow Parallel Facts on WhatsApp Channel: https://whatsapp.com/channel/0029VaCQSAoHgZWiDjR3Kn2E

Leave a Reply