Nigeria is actively seeking $1.5 billion in aid from the World Bank to address the severe dollar shortage, which is contributing to the depreciation of the naira.

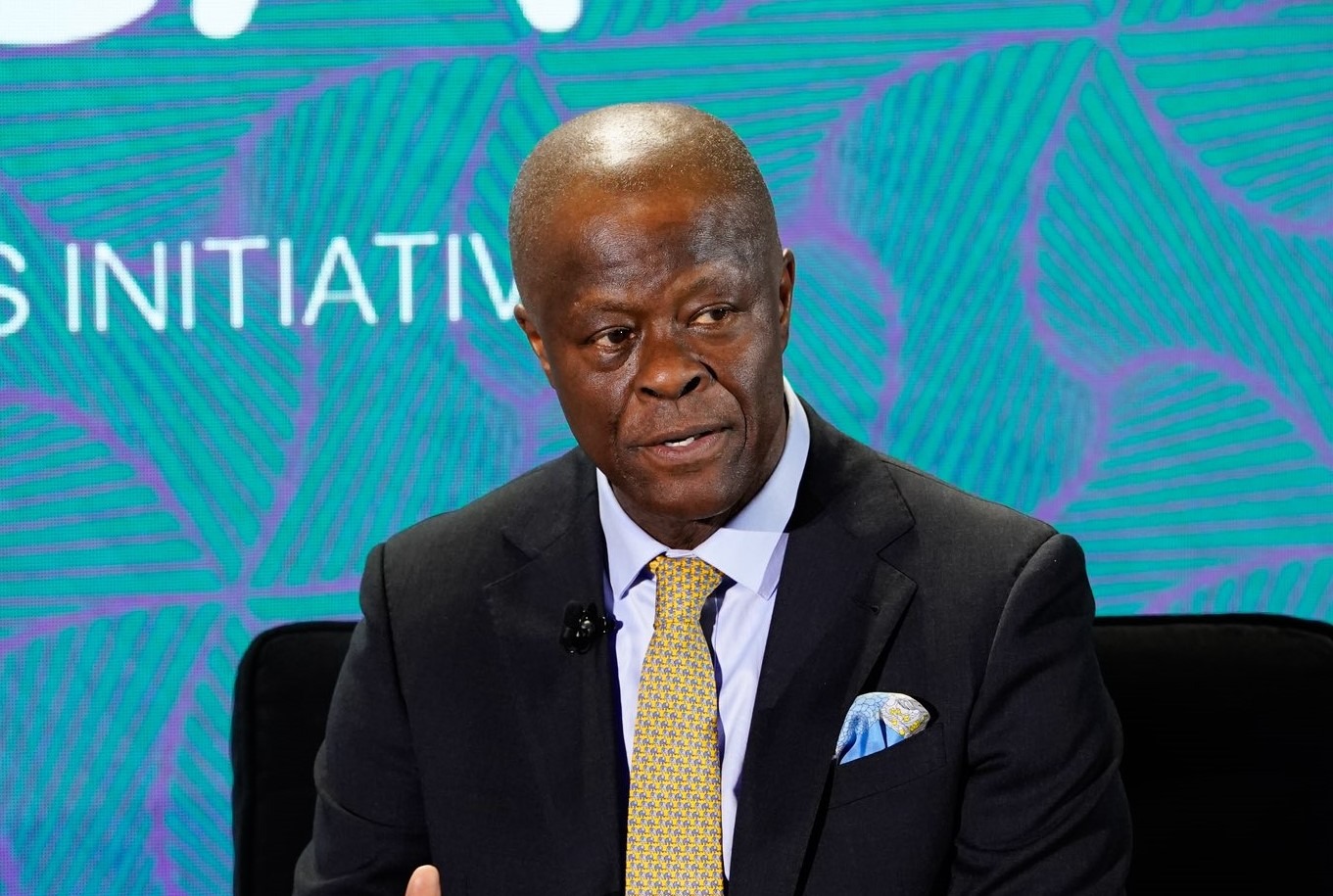

Finance Minister Wale Edun expressed optimism about obtaining $1 billion to $1.5 billion in budgetary support from the World Bank, citing the country’s ongoing economic reforms as justification for international assistance.

Edun also mentioned the possibility of issuing a Eurobond in late 2024, denominated in foreign currencies, to navigate the challenging economic conditions.

The Finance Minister emphasized that the country’s commitment to reforms makes it deserving of support and expressed confidence in securing the needed assistance.

Nigeria has previously issued Eurobonds to raise debt for infrastructure and economic development. In 2022, the country entered international debt markets with a $1.25 billion Eurobond issuance, marking its eighth venture into this financial arena.

During a press conference in October 2023, Edun disclosed that the $1.5 billion World Bank loan would come with a zero-interest rate. The funds are intended to finance development projects, with the minister assuring that the facility would be disbursed to Nigeria soon.

Despite Nigeria’s manageable debt, which the International Monetary Fund acknowledged, the country faces high interest payments.

READ ALSO: Asiwaju Bola Tinubu’s Baby, Toyin Abraham Laments As Pirates Hijack Her Newly Released Movie

The Finance Minister highlighted that the new World Bank loan aims to alleviate economic challenges, particularly addressing a budget deficit fueled by factors such as rising fuel subsidy costs, debt servicing, and constrained public spending.

Bola Tinubu outlined a multifaceted financing approach to address the deficit, including new borrowings, privatisation proceeds, and drawdowns on multilateral and bilateral loans earmarked for specific development projects.

Nigeria is grappling with persistent dollar shortages, increased demand for dollars, and speculative activities that have led to the devaluation of the naira.

The shortage of dollars has widened the gap between official and parallel market exchange rates, resulting in the naira falling to a record low of N1,320 per dollar on Wednesday.

The Central Bank of Nigeria has taken steps to boost confidence in the foreign exchange market by disbursing funds to settle outstanding forex forwards.

Leave a Reply