Despite having crude oil in abundance, Nigeria has consistently failed to meet oil production targets as stipulated in national budgets over the last 10 years.

The country has, over time, maintained a mono-economy with crude oil sales constituting about 90 per cent of its foreign exchange earnings.

However, experts have projected that non-oil exports should be the nation’s primary concern due to the volatility in the oil sector which Nigeria is susceptible to.

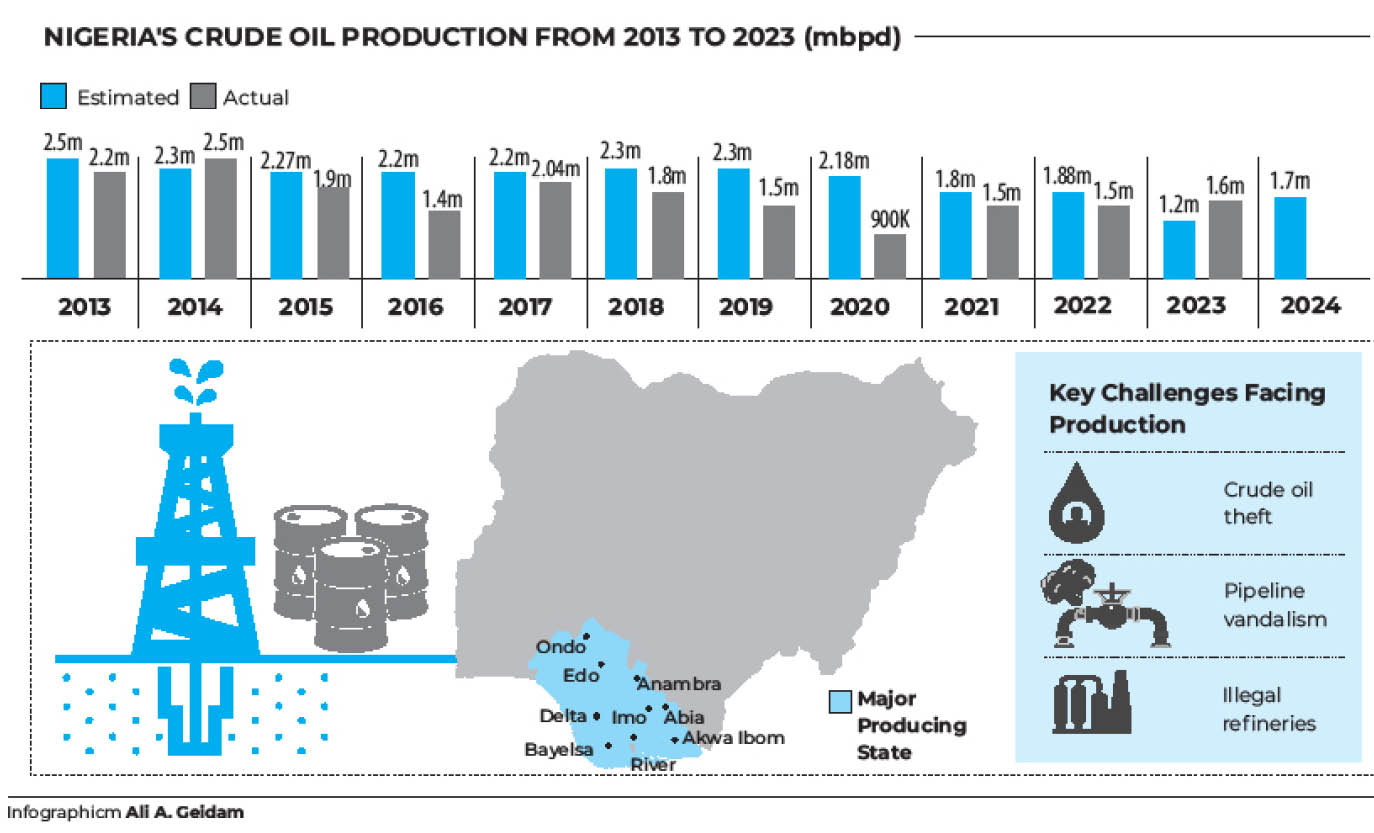

Data obtained by this newmen showed that the country consistently failed to meet its oil production targets by an average of 300,000 to 600,000 barrels per day (bpd) recorded shortfalls from 2013 to 2023.

READ ALSO: More Affliction for Nigerians as CBN Raises Import Duty Rate from N1,356.883 to N1,423/$ Within 24 Hours

A breakdown of the data showed that in 2013, Nigeria produced between 2.1 million and 2.2 million barrels of crude oil.

The then Minister of Finance and Coordinating Minister for the Economy, Ngozi Okonjo-Iweala had said that Nigeria was losing $1 billion in revenue monthly, following the drop in oil production and the falling prices of crude oil at the international market.

“Total losses, which stemmed from shut-in due to force majeure declared by oil companies, oil theft and illegal bunkering, was put at 300,000 barrels per day. The current production ranged from 2.1 million bpd to 2.2 million barrels per day, less than an estimated 2.5 million barrels per day for the 2013 budget,” she had said.

In the 2014 budget, crude oil production was pegged at 2.3883 million barrels per day. However, the figures from the Nigerian National Petroleum Company Limited (NNPCL), then a public corporation, showed that 2.05 million barrels per day (mbpd) of crude were produced that year, a shortfall of at least 450,000 barrels.

In 2015, former President Goodluck Jonathan signed the budget with a projection of 2.27 million bpd, and a crude oil price of $65. However, Nigeria’s oil production averaged 1.9 million bpd in 2015, representing a shortfall of over 300,000 bpd.

Subsequently, the 2016 budget was prepared as Nigeria was on the verge of exiting recession, and oil production was pegged at 2.2 million bpd.

By May 2016, Nigeria’s oil production had fallen drastically to 1.4 million bpd, nearly a 30-year low. After some government interventions, some of the disrupted productions were restored, and crude oil output averaged 1.6 million bpd in June, and continued in that trajectory until the end of the year.

Similarly, in the 2017 budget, oil production was pegged at 2.2 million bpd and the oil price was $42.5 bpb. However, crude oil production has been far below projections as the Medium-Term Expenditure Framework for 2018 showed that the 2.2 million bpd was not met as average oil production fell to 2.04 million bpd.

A similar situation recurred in relation to the 2018 budget which had a proposal of 2.3 million bpd but actual production was pegged at 1.84 million bpd by the then NNPC.

Also, in 2019, oil production was projected at 2.3 million bpd with crude oil price pegged at $60 per barrel. However, crude oil production by Nigeria fell for the third month in a row in December 2019, to a new low of 1.5 million bpd as against a target production level of 2.18 million bpd at $57 per barrel.

In 2020, the assumption of oil production of 2.18 million bpd was presented by the federal government with an oil price benchmark of $57 per barrel.

However, in the year under review, total crude oil production in Nigeria dropped to about 900,000 barrels per day as a result of the effects of COVID-19.

In the same vein, the 2021 budget was based on an oil price benchmark of US$40 per barrel, and an oil production output of 1.86 million barrels per day, although Nigeria had to shed off about 313,000 bpd for the first half of 2021 in line with Organisation of Petroleum Exporting Countries (OPEC)+ cut agreement to stabilise global oil prices. Nigeria produced an average of 1.4 million bpd of crude. At the end of the year, the country ended up producing a maximum of 1.5 mbpd, as reported by Daily Trust.

Leave a Reply