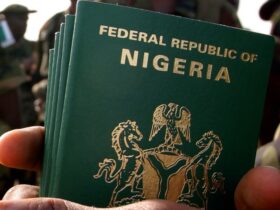

The federal government is actively seeking fund managers for a proposed $10 billion diaspora fund aimed at bolstering dollar inflows and attracting foreign investment into the economy, according to a tender document.

This fund aims to consolidate the billions of dollars remitted monthly by Nigerian citizens living abroad for domestic investments, particularly in infrastructure, healthcare, and education.

Last year, Nigeria reportedly received over $20 billion in diaspora remittances, as per the World Bank. The Ministry of Industry and Trade of Nigeria has publicly announced its quest for “fund managers for the development and establishment of a multisectoral, multilateral private sector-led investment fund to form the $10 billion Nigeria Diaspora Fund.”

The responsibilities of the fund manager entail crafting and establishing the fund, encompassing legal, operational, financial, and administrative frameworks, as outlined in the tender document.

READ ALSO: Lagos-Calabar Coastal Highway: FG Begins Demolition for First 3km Saturday

The anticipated investment horizon spans three to five years initially, with potential for subsequent investment. The fund’s duration is set at 10 years, with a provision for extension by two years, as stated by the government.

The tender issued by the trade ministry specifies that potential fund managers must have a demonstrable business presence in Nigeria over the past five years, along with a track record of capital raising and successful management of substantial venture capital funds. Minister of Industry and Trade, Doris Anite, expressed that this initiative presents an “unprecedented opportunity for our citizens in the diaspora to steer Nigeria’s economic advancement.”

The depreciation of the naira, driven by foreign currency shortages stemming from reduced crude oil exports, has heightened the demand for dollars, leading to reliance on the black market. To address these challenges and further boost foreign exchange inflows, Nigeria intends to issue diaspora bonds later this year.

Leave a Reply