A new report from BMI, a subsidiary of Fitch Solutions, projects that the naira could depreciate to N1,993 per U.S. dollar by 2028, creating substantial challenges for Nigeria’s pharmaceutical industry, especially in the importation of essential medical devices.

Titled “Weak Naira and Structural Challenges to Constrain Nigeria’s Medical Devices Market Growth,” the report predicts that despite potential economic recovery, Nigeria’s medical device market will face both operational and demand-related obstacles in the short term.

The report highlights Nigeria’s dependence on imports for more than 95% of its medical devices, leaving the sector vulnerable to exchange rate volatility.

“A persistently weak naira will drive up import costs for medical devices and reduce consumer purchasing power. Like other sub-Saharan African markets, Nigeria is overwhelmingly dependent on imports for its medical devices, with over 95% reliance,” the report noted.

READ ALSO: Peter Obi Donates Another N60m to University, College of Nursing (Photos)

“We expect that the naira will end 2028 at N1,993/$ from N306/$ in 2018. As the naira weakens, the cost of importing medical devices will continually increase, eroding both the health system and patient purchasing power especially to invest in essential medical technologies given underfunding of the public health sector.

“This would particularly affect high-cost demand for devices such as diagnostics, orthopaedics and dental products. On the export front, a weaker naira will enhance the competitiveness of locally manufactured medical devices, fostering growth in the sector,” the report stated.

BMI noted that while a weaker naira might boost the competitiveness of locally manufactured medical devices, ongoing challenges hinder substantial local production.

Key barriers include a shortage of skilled labor, limited access to advanced technology, and inadequate infrastructure, all of which continue to stifle manufacturing growth despite government incentives.

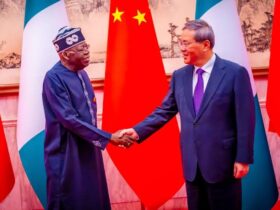

In response, Bola Tinubu’s administration introduced measures to alleviate these challenges, including an executive order in June 2024 that removed tariffs, excise duties, and VAT on specific machinery, equipment, and raw materials to help lower production costs.

However, BMI highlighted that the medical devices market will likely continue to face obstacles in the short term.

The report projects that Nigeria’s medical devices market could reach a value of N171.1 billion (£344.7 million) by 2028, driven by a large population, a growing focus on universal health coverage, and the combined burden of chronic and communicable diseases.

Nigeria’s economy is expected to recover in 2025, with growth forecasted at 3.0 percent for 2024, up from 2.9 percent in 2023.

Yet, persistent issues—such as high inflation, tighter monetary policies, and weak foreign direct investment—could weigh on the sector’s growth.

Additionally, the PUNCH reported that on Monday, November 11, 2024, the naira traded at N1,681.42 per dollar, marking a slight 0.15 percent dip from Friday’s closing rate of N1,678.87 on November 8, 2024.

FX turnover in the official market also fell sharply by 66.41 percent, dropping from $1.4 billion on Friday to $471.5 million on Monday, indicating reduced market activity.

During this period, the naira fluctuated, reaching a high of N1,695 and a low of N1,631.

Follow the Parallel Facts channel on WhatsApp: https://whatsapp.com/channel/0029VaCQSAoHgZWiDjR3Kn2E

Leave a Reply