The naira continued its downward trend after exchanging to the dollar at N1050 to the dollar on Thursday, as demands continue to regularly exceed supply.

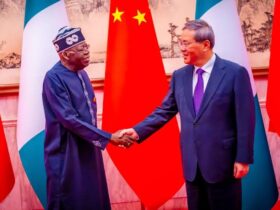

Consequently, the naira has lost more than 40 per cent against the US dollar since the mid-June devaluation following the emergence of Bola Tinubu-led administration.

Although the measures were aimed at improving the country’s financial and foreign accounts, the inflationary impact was short-lived.

Furthermore, the dollar index, a measure of the US currency against its six rivals, was at 105.64, not far from 105.55, its lowest since September 25.

The dollar was little changed but hovered near a two-week low on Thursday after minutes from the Federal Reserve’s latest meeting showed that policymakers were taking a cautious stance, as Investors wait for important data on US inflation.

According to the minutes released on Wednesday, Fed officials emphasised that uncertainties regarding the economy, oil prices, and financial markets supported;

“the case for carefully determining how much additional policy tightening may be appropriate. Rising bond rates have been mentioned by Fed members as a factor that might allow them to stop the rate-hike cycle in recent remarks”.

The CME FedWatch tool highlighted that the futures markets are pricing in a 26 per cent chance of a 25-basis point hike at the December meeting and a 9 per cent chance of a 25-basis point hike at the November meeting.

The dollar’s recent weakness has been driven by falling Treasury yields as bond prices rose following the Fed’s softer stance on future rate hikes, according to Tribune report.

It be recalled that the parallel market breached the N1,000/$1 threshold in September, initially perceived by some analysts as a temporary occurrence.

The government’s inability to attract forex inflows has resulted in an ever-depreciating exchange rate with continuous declines.

Leave a Reply