Chief Bola Ahmed Tinubu is setting his sights on the banking sector with a new windfall tax aimed at lenders. This tax will target banks’ foreign currency revaluation gains, and the revenue generated is expected to partially finance the government’s spending plans.

Bola Tinubu has write to the Senate to support a new legislation aimed at taxing the substantial income banks earned last year from the revaluation of their foreign currency-denominated assets.

This income surge was triggered by a steep decline in the value of the naira, which significantly increased the value of these assets when converted into the local currency.

Tinubu’s proposal seeks to capitalize on this windfall to enhance government revenue. By targeting these bumper profits, he aims to generate funds necessary to support the country’s fiscal policies and development projects.

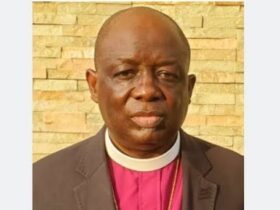

“A proposed amendments to the Finance Act Amendment Bill 2023 are required to impose a one-time windfall tax on the foreign exchange gains realised by banks in their 2023 financial statements,” President Tinubu said in a letter to the Senate, read on the floor of the upper parliament on Wednesday by Godswill Akpabio, the senate president.

READ MORE; Tinubu’s Government Imposes 7.5% Value-Added Tax on Cryptocurrency Transactions

The tax will help “fund capital infrastructural development, education and healthcare access as well as public welfare initiatives all of which are essential components of the Renewed Hope Agenda,” he added.

As reported by PremuimTimes the Windfall tax receipts helped Nigeria’s African peer South Africa in 2022 to pay down debt and repair public sector infrastructures. The government hopes it could help cut public debt as a share of GDP to 69 per cent by 2024/2025 from 71.4 per cent in 2022/2023.

Follow the Parallel Facts channel on WhatsApp: https://whatsapp.com/channel/0029VaCQSAoHgZWiDjR3Kn2E

Leave a Reply