Edo State Governor, Godwin Obaseki, has expressed skepticism regarding the effectiveness of the current policies implemented by the Central Bank of Nigeria (CBN) in fostering the necessary economic growth for the country.

Governor Obaseki highlighted his concerns, stating that the elevated interest rates introduced by the apex bank would consistently impede Nigeria’s economic expansion, particularly hindering small business owners’ access to loans.

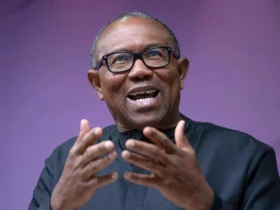

In a viral video recorded during an event organized by the Edo Zone of Bankers’ Committee in Benin City, Governor Obaseki emphasized, “Policies recently rolled out by the central bank, unfortunately, will not bolster the growth of our economy.”

He criticized the focus on increasing the monetary policy rate, asserting that Africa’s largest economy does not solely rely on exchange rates for survival.

READ ALSO: SIM/NIN Linkage: 11.2m Mobile Lines Barred Says NCC

Obaseki urged for the development of indigenous policies by the federal government and CBN leadership to foster job opportunities for youths and enhance productivity in the country.

He emphasized the need to concentrate on fundamental aspects such as increasing production and reducing dependence on imports, rather than solely fixating on exchange rates.

Governor Obaseki stressed the importance of synergy between fiscal and monetary policies, emphasizing that both must work in tandem to avert potential crises in Nigeria’s economy.

He advocated for a shift in focus towards addressing fiscal issues to steer the economy out of its challenges, suggesting that job creation for young people should be prioritized over concerns about foreign exchange.

He said, “I understand the monetary rationale for increasing MPR fundamentally and fiscally, it is not going to lead to growth in our economy. We must focus on the fundamentals which are increasing production, making sure our citizens produce goods and services we consume, and depend less on imports.

“Our economic policy and monetary policy cannot be determined by exchange rate alone, so the issue of increasing cash reserves in the bid to tighten the liquidity is going to be detrimental to our economy.

“I understand the challenge the monetary authorities face, but unfortunately, you cannot clap with one hand. The economy is about fiscal and monetary policies – both must work hand-in-hand and when they don’t as they don’t in Nigeria, there can be a crisis.

“We should focus on fiscal issues so that we can grow our economy out of the challenges we had. We should not panic too much because of foreign exchange. We must focus on how we can do things within our economy, and how we can grow our economy and earn more foreign exchange if foreign exchange is our problem, but I believe creating jobs for young people should be more of a priority for us as people at this time.”

Leave a Reply