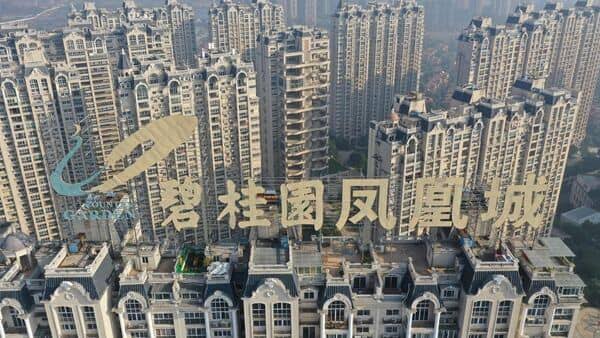

China is currently grappling with a severe property crisis. The troubled Chinese developer, Country Garden, is on the brink of its first actual default on an offshore debt. The grace period for a US$15.4 million payment is entering its final hours, adding to the growing concerns about the health of the country’s real estate sector.

The real estate developer has announced that it failed to make a principal payment of 470 million Hong Kong dollars, or $60 million. The company anticipates that it will not be able to fulfill all its payment obligations outside China when they are due or within the relevant grace periods.

The developer has $11 billion worth of outstanding offshore bonds, according to Bloomberg. The developments at Country Garden are being closely monitored, as the company, which had nearly $200 billion in liabilities at the end of 2022, is the latest high-profile Chinese real estate giant to face a liquidity crunch in two years as China’s economy struggles to recover from the COVID-19 pandemic

China’s real estate sector has been embroiled in a crisis since 2021, when Evergrande, once China’s second-largest developer, encountered a liquidity crisis. It defaulted on an offshore dollar bond for the first time in December of that year.

Other Chinese real estate developers have faced similar issues and have started defaulting on their bond payments. This has raised concerns that the crisis could spread to other sectors in the country and globally.

While Country Garden’s liabilities are significantly lower than Evergrande’s $300 billion pile, Country Garden has around 3,000 unfinished projects. This is approximately four times the number of Evergrande’s 800 projects that are still under construction.

Leave a Reply