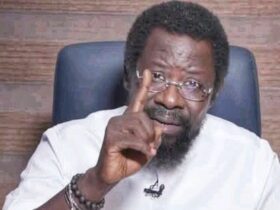

Shehu Sani, the ex-Senator for Kaduna Central, has said that had his warnings been heeded regarding former governor Nasir El-Rufai’s pursuit of loans, Kaduna State wouldn’t be ensnared in its present quagmire of a multi-million dollar debt.

Sani, addressing reporters, recounted being scorned for opposing the $350 million World Bank loan sought by the El-Rufai administration at the time.

Sani said, “The hour of reckoning has come for every citizen of the state.”

“I was insulted for saying no to that loan. The hour of reckoning is here for every person in Kaduna State.

“Just like the way Lot (in the Bible) warned people, prophets of the past warned people, but they refused to hear…”

“In the same way, I warned the people of this state, but they were told that the money will bring paradise, a land of milk and honey.”

READ ALSO: I Inherited N85bn, $587m Debts, Can’t Pay Salaries Now-Kaduna Gov Laments

“Today, you can see the problems at hand as far as that loan was concerned. If you look at what I said about this state, there has never been any of my predictions that has not come to pass..Today the state is strangulated because of that money which we couldn’t pay,” he said.

During a Town Hall Meeting on Saturday, Governor Uba Sani expressed concern over the significant debt burden, which he stated was severely impacting the State’s Federal Allocation.

Sani added that due to the escalating exchange rates, Kaduna state is now obligated to repay nearly three times the amount borrowed during the previous administration led by Nasir Ahmed El-Rufai.

He noted that out of the N10 billion Federal Allocation allocated to Kaduna State in March, seven billion was deducted to service the State’s debt.

This deduction left the state with a mere N3 billion, which is insufficient to cover the monthly salary bill of N5.2 billion.

The Governor emphasized the critical financial challenges facing the state, indicating the urgent need for strategies to address the growing debt burden and ensure financial stability.

Leave a Reply