The ongoing conflict between billionaire businessman Femi Otedola and Jim Ovia, chairman of Zenith Bank, has intensified due to allegations of a multibillion naira fraud.

Otedola claims that Zenith Bank unlawfully used the account of his company, Seaforce Shipping Limited, for trading activities in 2011 without his knowledge or consent.

These allegations, along with others, are currently being investigated by the Force Criminal Investigation Department (FCID) of the police, although efforts are being made to resolve the issues amicably.

Unauthorized Transactions

Despite Seaforce Shipping’s account being inactive since 2010, it was allegedly used for unauthorized trading, unknown to Otedola, according to his police petition.

Otedola asserts that Seaforce never applied for or received a loan from Zenith Bank, yet unauthorized trading worth billions of naira continued on the account.

Zenith Bank reportedly failed to provide documentation, such as offer letters, to support the granting of these loans when requested.

Otedola discovered these suspicious activities only recently, 13 years after the transactions when a whistleblower from Zenith Bank tipped him off.

READ ALSO: Tinubu Names Northern Parkway Road After Prof Wole Soyinka

Upon confronting Zenith Bank officials, Otedola reportedly received an apology.

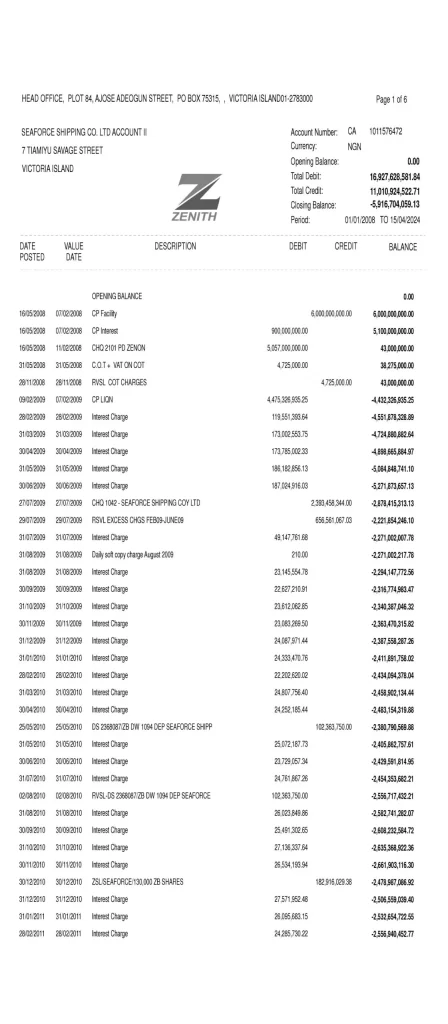

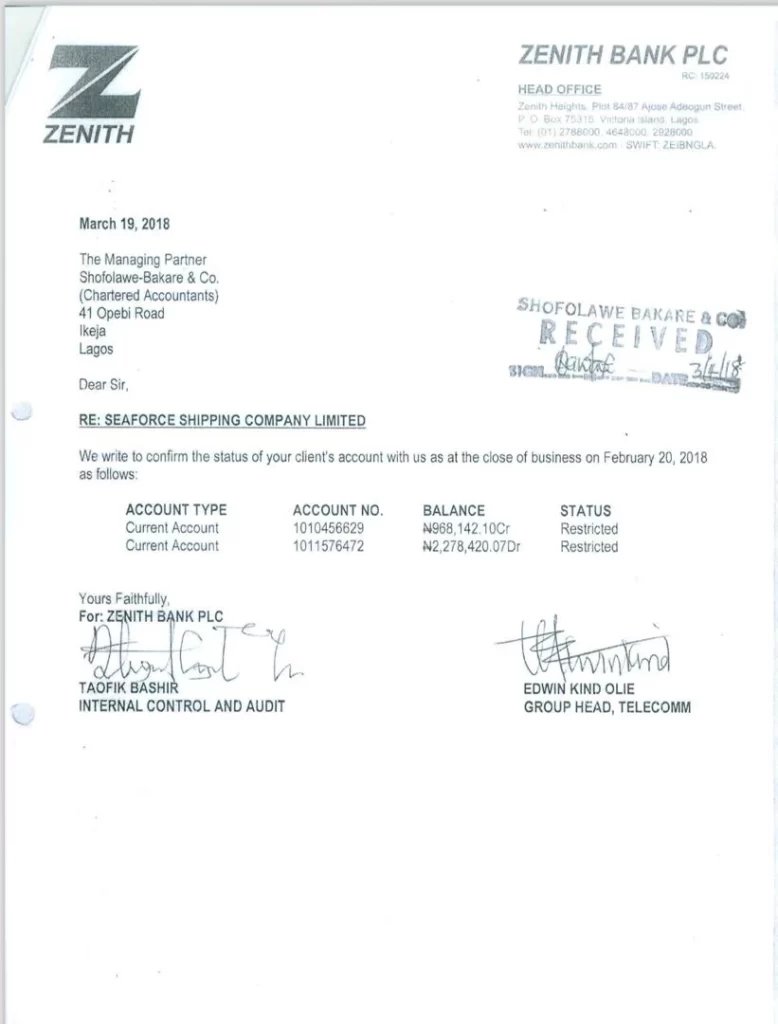

A letter dated March 19, 2018, from Zenith Bank to Shofolawe-Bakare & Co, Seaforce’s auditors, stated a debt of only N2,278,420 on the same account, contrary to the N5 billion recorded in the bank statement seen by TheCable.

On the day the letter was written, the bank statement showed a debt of N2.9 billion, compared to the N2 million stated in the letter signed by Taofik Bashir (internal audit control) and Edwin Kind Olie (group head, telecom).

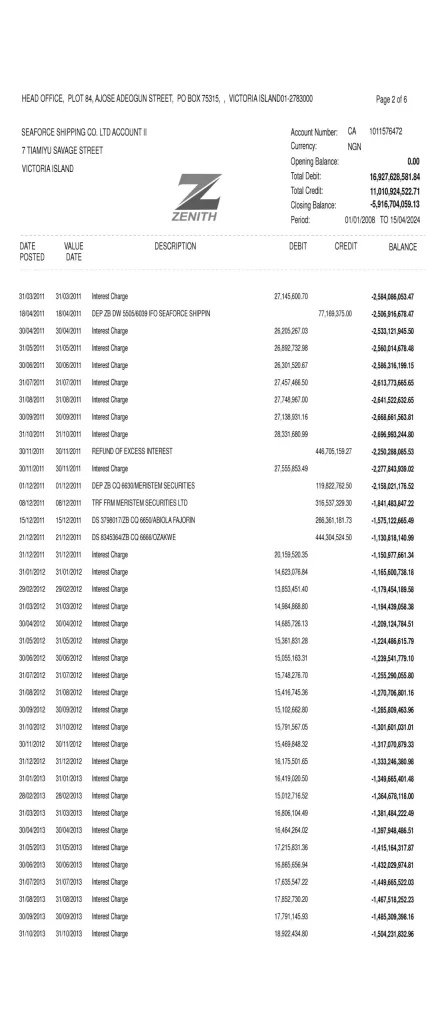

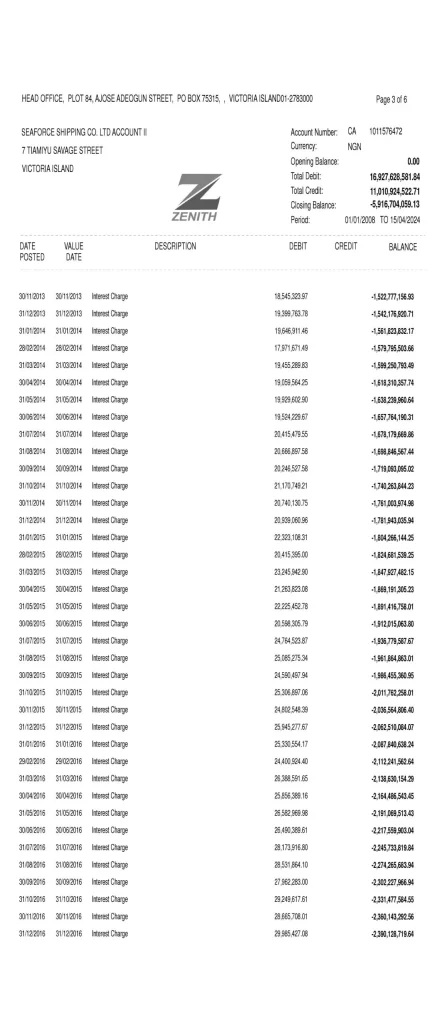

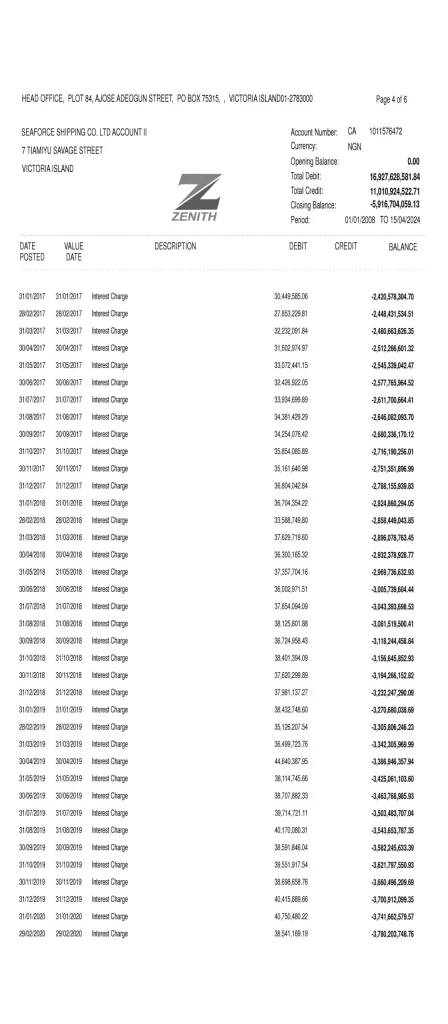

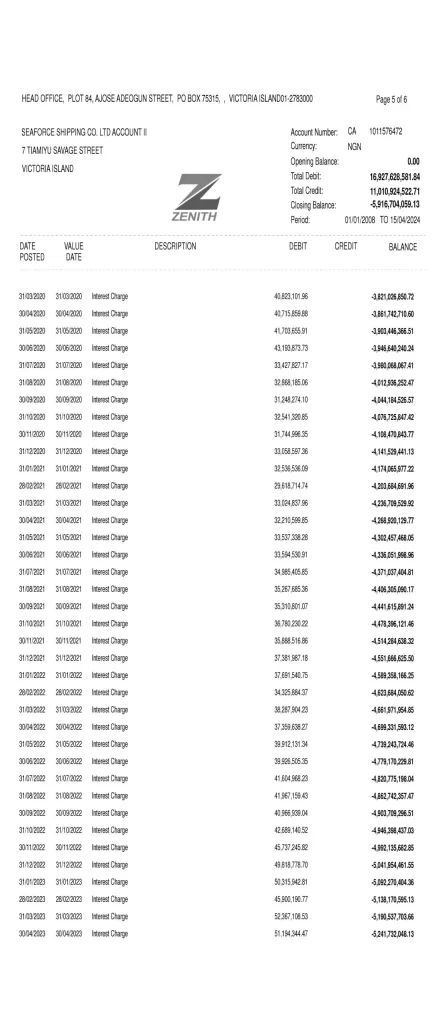

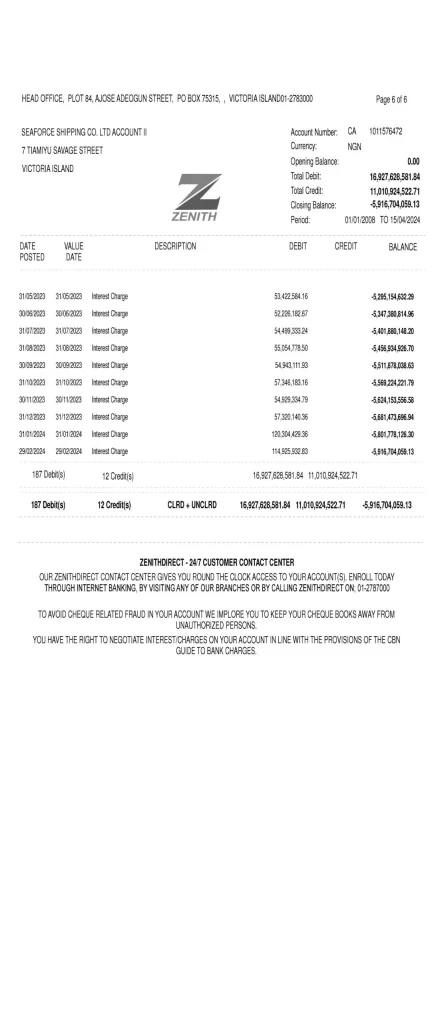

Transactions totaling over N16 billion were recorded against Seaforce’s account from 2011 to 2024.

Otedola questioned who made the payments that reduced the purported debt from N16.9 billion to N11 billion, as he was unaware of these transactions.

Significant credits included N77,169,375 on April 18, 2011, N119,822,762.50 on December 1, 2011, N316,537,329.30 on December 8, 2011, N266,361,181.73 on December 15, 2011, and N444,304,524.50 on December 12, 2011.

Seaforce now has a debt of N5,916,704,059.13, with a significant portion attributed to interest charges.

A senior official of the bank has already been questioned by the police.

Meanwhile, Zenon, Seaforce, Luzon Oil and Gas, Garment Care Limited, and Otedola have secured a federal high court injunction against Zenith Bank, Quantum Zenith Securities and Investment, Veritas Registrar, and Central Securities Clearing System. This injunction restrains these entities from trading with shares or paying dividends.

The injunction will remain in place until the hearing of the motion on notice for an interlocutory injunction.

Follow the Parallel Facts channel on WhatsApp: https://whatsapp.com/channel/0029VaCQSAoHgZWiDjR3Kn2E

Leave a Reply