Lagos State government has announced plans to generate N200 billion annually by expanding its income tax through freelancers and influencers.

This, the state intends to achieve by leveraging digital solutions for enhanced revenue collection.

Also, the state plans to raise its Internally Generated Revenue (IGR) to N5tn from four major sectors.

The digital economy is one of the sectors through which the state plans to raise its IGR, by introducing a Resident Global Digital Citizen Tax Management System, targeting remote workers, foreign firms, and digital influencers (content creators).

It will also involve accreditation and licensing of digital economy operators, supported by a robust platform including e-portal, marketplace, and a recovery platform.

This is contained in the synopsis for the Eko Revenue Plus Summit, scheduled to hold from September 25 to 26, 2024, under the theme “Unlocking New Revenue Streams for Lagos State”.

READ MORE: Lagos Govt Revokes Existing Building Permits; Orders Property Owners to Reapply

“Increasing Lagos State IGR to 5 Trillion Naira in the life of the current administration requires a comprehensive and innovative approach that leverages technology, strengthens tax administration, expands the tax base and explores new revenue stream options, especially in the non-tax areas, while optimizing the existing processes,” the document read partly.

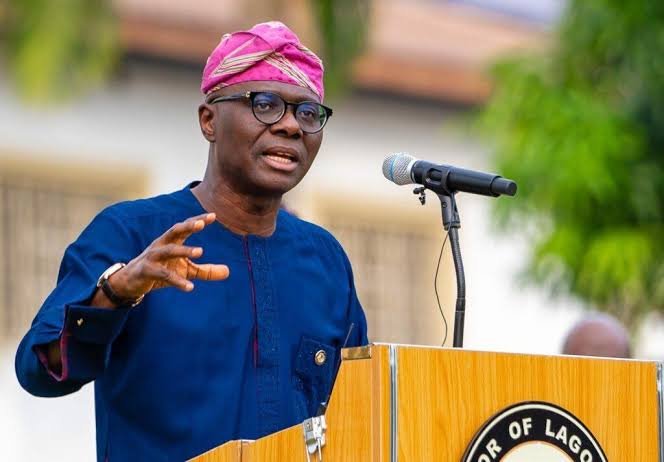

In June, the state Governor, Babajide Sanwo-Olu, claimed that out of the 54 countries in Africa, only seven of them have the Gross Domestic Products (GDPs) bigger in size than that of Lagos.

According to him, the state’s GDP has grown by almost 50 percent in the last five years under his administration.

Follow the Parallel Facts channel on WhatsApp: https://whatsapp.com/channel/0029VaCQSAoHgZWiDjR3Kn2E

Leave a Reply