The International Monetary Fund (IMF) has highlighted that Nigeria’s currency, the naira, is showing signs of stabilizing, thanks to recent interest rate hikes and the clearing of foreign exchange backlogs by the Central Bank of Nigeria (CBN).

This update was shared during the launch of the IMF’s global financial stability report at a press briefing held in Washington, D.C., on Tuesday.

The IMF’s assessment follows actions taken by the CBN earlier in the year to tackle Nigeria’s foreign exchange issues. On March 20, the CBN announced it had settled all verified outstanding foreign exchange (FX) obligations, although an unverified $2.4 billion remains under investigation.

“in Nigeria, rate hikes and the clearing of overdue domestic central bank foreign exchange obligations have helped the naira show more signs of stability,” the IMF stated in its report.

Under the leadership of Governor Olayemi Cardoso, the Central Bank of Nigeria (CBN) has introduced several interest rate hikes to tackle the country’s ongoing inflation challenges.

Most recently, on September 24, the CBN’s Monetary Policy Committee (MPC) increased the interest rate by 50 basis points, raising it to 27.25 percent.

However, this decision drew swift criticism from major business organizations, including the Manufacturers Association of Nigeria (MAN) and the Lagos Chamber of Commerce and Industry (LCCI).

The groups contended that raising interest rates would harm the manufacturing sector and stifle business growth.

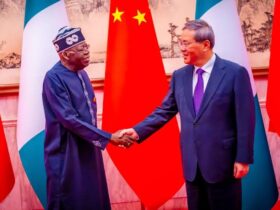

Tobias Adrian, the IMF’s financial counsellor and director of monetary and capital markets, commended the CBN’s efforts to stabilize the naira and manage inflation.

During the press briefing, Adrian recognized the CBN’s move towards an inflation-targeting policy and its liberalization of the exchange rate system.

His words: “The central bank has been transitioning to an inflation-targeting regime and has liberalized the exchange rate, which we welcome.

“The rate hikes implemented so far have been appropriate, especially given the challenges posed by high inflation, which still stands around 30 percent.”

Despite the recent gains in naira stability, the currency has struggled in 2024. On October 16, the World Bank reported that the naira remains one of the worst-performing currencies in sub-Saharan Africa.

However, the IMF noted that the currency has shown signs of improvement in recent months, fluctuating between N1,700 and N1,600 per dollar in the parallel market and stabilizing between N1,500 and N1,600 in official trading windows.

Follow Parallel Facts on WhatsApp Channel: https://whatsapp.com/channel/0029VaCQSAoHgZWiDjR3Kn2E

Leave a Reply