Finance Minister Wale Edun says Nigeria anticipates a large inflow of foreign exchange in the upcoming weeks.

The estimated $10 billion inflow is expected to alleviate the country’s foreign currency market’s liquidity issues.

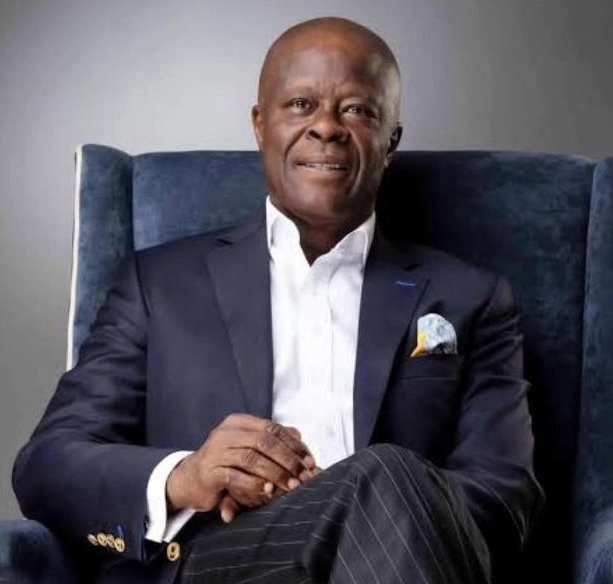

Speaking on Monday at a panel discussion at the ongoing Nigeria Economic Summit (NES) in Abuja, Mr. Edun revealed this information.

In both authorized and unauthorised market segments, the value of the Nigerian Naira has decreased by more than 50% in the last few months.

The Central Bank of Nigeria (CBN) decided in June to combine all FX windows into one, known as the Investors and Exporters (I&E) window, which led to this depreciation.

The action was a component of the Nigerian government’s attempts to increase market stability and liquidity and draw in foreign capital to boost the country’s economy.

Though it was a well-intentioned move, it has further strained the local currency and manufacturers, which has had an impact on domestic prices.

Minister Edun said that the government can see foreign exchange inflows into the nation “in weeks rather than months” while speaking at the Nigerian Economic Summit in Abuja. He went on to say that an executive order signed by Tinubu effectively permits all cash in the domestic economy to lawfully enter the formal money supply during a period of forbearance.

Also, the issuance of foreign currency instruments domestically is permitted by another executive decree. Providers will be encouraged by this approach to deliver foreign exchange from a variety of sources.

On October 20, the naira dropped to almost 1,000 per dollar on the official market due to the dollar’s unquenchable demand.

The actions taken by the government are anticipated to supplement other initiatives being undertaken to increase foreign exchange liquidity, such as enhancing market transparency.

Leave a Reply