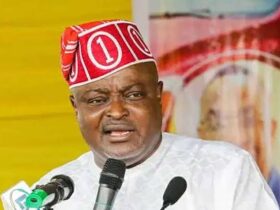

Bola Ahmed Tinubu has obtained a $500 million loan from the World Bank to support electricity Distribution Companies (DisCos).

Recall that according to the National Bureau of Statistics (NBS), Nigeria’s public debt stock which includes external and domestic debt stood at N87.38 trillion (US$113.42 billion) in Q2 2023 from N49.85 trillion (US$ 108.30 billion) in Q1 2023, indicating a growth rate of 75.27% on a quarter-on-quarter basis.

Total external debt stood at N33.25 trillion (US$43.16 billion) in Q2 2023, while total domestic debt was N54.13 trillion (US$70.26 billion).

The share of external debt (in naira value) to total public debt was 38.05% in Q2 2023, while the share of domestic debt (in naira value) to total public debt was 61.95%.

In a statement released yesterday in Abuja, the Bureau of Public Enterprises indicated that the loan collected by Tinubu ‘s administration is intended to address financing gaps in the distribution segment, which is regarded as the most problematic part of the industry.

“This funding supports the Nigerian Distribution Sector Recovery Program (DISREP) aimed at improving the financial and technical performance of the DisCos.

“The DISREP is designed to enhance the financial and technical operations of the DisCos through capital investment and the financing of key components of their Performance Improvement Plans (PIPs), which have been approved by the Nigerian Electricity Regulatory Commission (NERC),” the Bureau said in the statement signed by Amina Othman, Head, Public Communications.

The $500 million DISREP loan offers concessional financing with more favorable terms than those available from commercial banks.

The expectation is that DisCos will invest these funds in critical distribution infrastructure to reduce ATC&C losses, increase power supply reliability, achieve financial sustainability in the power sector, and enhance transparency and accountability. Significant progress has been made in preparing the DISREP Programme, according to the Bureau of Public Enterprises (BPE).

The privatization agency highlighted key areas of improvement: bulk procurement of customer/retail meters and meter data management systems, implementation of a Data Aggregation Platform (DAP), and strengthening governance and transparency within the DisCos.

The DISREP loan, particularly the Investment Project Financing (IPF) component, is expected to significantly benefit the Nigerian Electricity Supply Industry (NESI).

It aims to close the metering gap, reduce Aggregate Technical, Collection, and Commercial (ATC&C) losses, improve remittances and liquidity for the DisCos, enhance the reliability of power supply, and increase transparency and accountability within the DisCos.

Follow the Parallel Facts channel on WhatsApp: https://whatsapp.com/channel/0029VaCQSAoHgZWiDjR3Kn2E

Leave a Reply