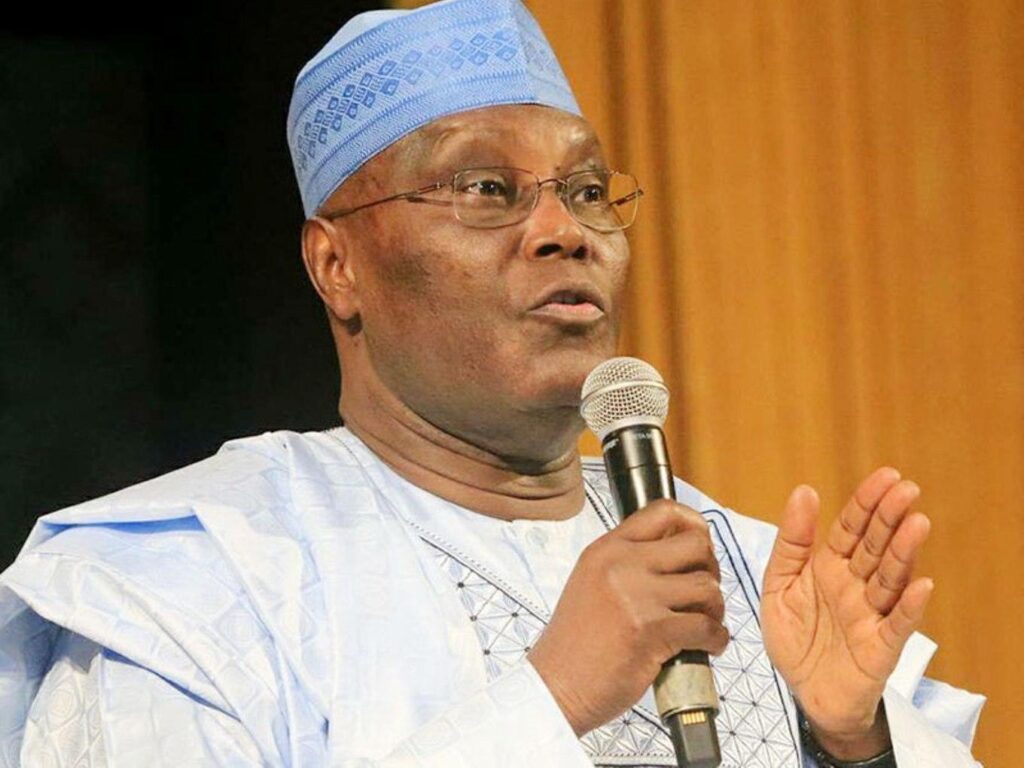

Former Vice President Atiku Abubakar has warned Bola Tinubu, urging him to refrain from exacerbating the financial hardships of the poor by implementing new taxes or raising existing tax rates.

Atiku highlighted the public’s awareness of clandestine efforts to hike the Value Added Tax (VAT) from 7.5% to 10%, reintroduce excise taxes on telecommunications, and increase excise rates on various goods.

The former presidential candidate of the Peoples Democratic Party (PDP) emphasized that relying solely on taxation as a solution to economic challenges is not viable.

Atiku stressed, “It must be emphasized that we cannot tax our way out of this predicament.”

Former Vice President Atiku Abubakar says President Bola Tinubu must be cautioned against any attempt to further pauperize the poor by introducing new taxes or increasing tax rates.

Atiku said people were aware of the behind-the-scenes attempts to increase VAT rate from 7.5% to 10%, re-introduce excise on telecommunication, and increase excise rates on a range of goods.

READ ALSO: Tinubu Considers Implementation of New National Tax, Spending, Borrowing Policies

According to the former presidential candidate of the Peoples Democratic Party, PDP, “It needs to be restated that we cannot tax our way out of this situation”.

In a statement issued on Wednesday and obtained by DAILY POST, Atiku claimed Tinubu was not prepared for the reform fallouts.

“Tinubu must be cautioned against any attempt to further pauperize the poor by introducing new taxes or increasing tax rates. We are aware of the behind-the-scenes attempts to increase VAT rate from 7.5% to 10%, re-introduce excise on telecommunication, and increase excise rates on a range of goods

“Tinubu must see the need for expenditure rationalization and restraint – by having the budget more in sync with Nigeria’s fiscal reality, by improving efficiency in revenue utilization, improving procurement processes and trimming the size of government – and therefore reducing the cost of governance,” he said.

Follow the Parallel Facts channel on WhatsApp: https://whatsapp.com/channel/0029VaCQSAoHgZWiDjR3Kn2E

Leave a Reply