According to data from the trading platform Naira Rates on Wednesday, the depreciation of the naira led to its further decline to N1,520.123 against the dollar.

This marks a significant drop compared to the N1,482.75 per dollar recorded in the official foreign exchange market the previous day, indicating a depreciation of N38 within 24 hours.

Tuesday’s decrease marked the first instance since the COVID-19 period that the official exchange rate surpassed the parallel market rate, which stood at N1,470 per dollar, up from N1,425 on Monday.

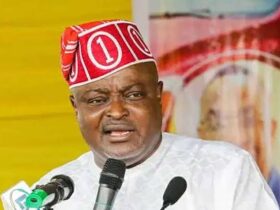

The monetary policies implemented by Chief Bola Tinubu’s administration contributed significantly to the naira’s continued decline following the currency float.

Tinubu’s economic strategies, including the elimination of fuel subsidies and consolidation of multiple foreign exchange windows into the single Importer and Exporter (I&E) window, led to a drastic 98% depreciation in the naira’s value, as reported by Price Water Coopers.

The firm’s report, ‘Nigeria’s Economic Outlook: Seven Trends That Will Shape the Nigerian Economy in 2024’, released last Wednesday, highlighted how these policies aimed to attract foreign investors and stimulate the economy in 2024.

Since hitting a historic low of N1000 against the U.S. dollar on September 26, the naira has lost 17% of its value, raising concerns about Tinubu’s fiscal policies and their impact on the economy.

READ ALSO: Paris Trip: Hand Over to Shettima to Tackle Insecurity—Ohanaeze Urges Tinubu

Despite the adverse effects such as inflation and reduced purchasing power, Tinubu’s administration has pursued what it terms strategic initiatives, including the removal of petrol subsidies and the adoption of a clean float foreign exchange management system.

These measures, though met with resistance and skepticism, reflect efforts to alleviate the government’s financial burdens and transition towards a more market-oriented economy.

Leave a Reply