World Bank’s International Debt Report for 2022 has named Nigeria among developing countries that collectively spent an unprecedented $443.5 billion to service their external public and publicly-guaranteed debt.

The report underscores the severe impact of rising debt-service costs on these nations, diverting crucial resources away from essential sectors such as health, education, and the environment.

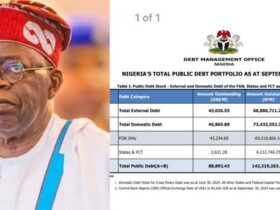

In April, the World Bank had raised concerns about Nigeria, stating that the country utilised a staggering 96.3% of its generated revenue in 2022 to service debt, exacerbating the nation’s already soaring public debt stock.

The latest report emphasizes that this trend is not unique to Nigeria, as all developing countries experienced a 5% increase in debt-service payments, encompassing both principal and interest. Of particular concern are the 75 countries eligible to borrow from the World Bank’s International Development Association (IDA), which supports the world’s poorest nations.

READ ALSO: Shoprite to Shutdown in Kano from January 2024, Blames ‘Poor Business Climate’

This group collectively faced a record $88.9 billion in debt-servicing costs in 2022. Over the past decade, interest payments for these countries have quadrupled, reaching an unprecedented $23.6 billion in 2022.

The report predicts a concerning outlook for the 24 poorest countries, anticipating a potential 39% increase in overall debt-servicing costs in 2023 and 2024.

Indermit Gill, Chief Economist and Senior Vice President of the World Bank Group, sounded the alarm, stating, “Record debt levels and high interest rates have set many countries on a path to crisis.

“Every quarter that interest rates stay high results in more developing countries becoming distressed—and facing the difficult choice of servicing their public debts or investing in public health, education, and infrastructure.

“The situation warrants quick and coordinated action by debtor governments, private and official creditors, and multilateral financial institutions—more transparency, better debt sustainability tools, and swifter restructuring arrangements. The alternative is another lost decade.”

Haishan Fu, Chief Statistician of the World Bank, stressed the importance of debt transparency for effective debt management, saying, “Knowing what a country owes and to whom is essential for better debt management and sustainability.

“The first step in avoiding a crisis is having a clear picture of the challenge. And when problems arise, clear data can guide debt restructuring efforts to get a country back on track towards economic stability and growth.

“Debt transparency is the key to sustainable public borrowing and accountable, rules-based lending practices which are so vital to ending poverty on a livable planet.”

The report noted that IDA-eligible countries have spent the last decade adding to their debt at a pace that exceeds their economic growth—a red flag for their prospects in the coming years.

It revealed in 2022 alone, the combined external debt stock of these nations reached an alarming $1.1 trillion, more than double the level recorded in 2012.

From 2012 through 2022, IDA-eligible countries increased their external debt by 134%, outstripping the 53% increase they achieved in their gross national income (GNI).

This worrying trend, as outlined in the report, signals potential challenges for these countries in the years ahead. #World Bank

Leave a Reply